Suppose you are planning to invest in FintechZoom QQQ Stock. Whether you want to buy or sell, it needs a deep analysis, expertise, and market conditions. Regarding the NASDAQ-100 index, QQQ stocks are considered tech and non-financial.

Q Stocks are ETFs (Extended Traded Funds) whose inception occurred in 1999 and is a collective partnership of big American technology players and some non-financial companies.

The Invesco QQQ ETF, known as QQQ stock, represents some of the most significant American technology and non-financial companies. It allows the investor to get some part of the innovative technology sector in terms of stocks rather than owning their whole stocks or making continual commitments.

Critical Aspects of The FintechZoom Q Stock

Technology Focus: The NASDAQ-100 index is diverse, comprising various companies from multiple sectors. On the other hand, FintechZoom Q Stocks ETF is primarily based on technology companies. The Invesco QQQ ETF is mainly the indicator of technology companies such as Google and Apple Inc. Facebook, Tesla, Microsoft, NVIDIA Corporation, Intel Corporation, and more.

Diversification: On an additional note, QQQ stock diversifies itself by including other fields in the healthcare sector, such as consumer services, consumer goods, and supply chain companies. Diversification makes it more diverse than just sticking to the tech ETF.

Growth-Oriented: The QQQ Stock mainly includes growth-oriented companies and is growth-oriented because it tracks the NASDAQ-100 Index. Tech companies like Apple, Google, Tesla, Microsoft, Intel, Amazon, OpenAI, and NVIDIA believe in innovation and heavily invest in research and development. Ultimately, these companies experience significant revenue growth due to innovations and increased product quality. Growth orientation property makes FintechZoom QQQ stock more profitable and the right choice for investing and getting it in their portfolios.

Investment Tool: As itsits contributors’ companies already have significant market caps, QQQ stocks ETF automatically grabs the attention of the pioneer community primarily. They get a bright chance of investing in ETF rather than investing in individual company stocks.

Performance: Looking into the history of QQQ stocks, the graphical growth is astonishing. Technology is getting massive upside growth shifts daily, month, and year. This upside trend is ultimately strengthening the QQQ Stock, and technology companies are getting bigger and bigger in a positive market trust-building environment.

The QQQ is a significant ETF for investors interested in the tech sector and broader market trends in innovative and large-cap companies in the NASDAQ.

Introduction To Fintechzoom On Qqq

FintechZoom is a reliable platform for investors that provides analysis and reports of the ETF performance of QQQ Trust. It visualizes the market capacity, growth, composition, and trends, thus enabling the investors to make the right decisions.

As it tracks the NASDAQ-100 index, QQQ Trust ETF is a joint venture of technology companies with huge potential for growth and innovation. The Fintechzoom QQQ stock gives investors an idea of their future investments, similar to GE stock Fintechzoom.

This platform also likely discusses investment strategies and the overall economic impact of tech giants included in QQQ. By leveraging FintechZoom, investors can better understand QQQ’s role in a diversified investment portfolio, informed by current data and expert analysis.

Market Relevancy of Q Stock FintechZoom

As you know, QQQ stock refers to the ETF that deals with tech companies. So, it serves as a parameter to analyze the tech industry’s performance. It acts as a growth indicator of technology companies and investment seekers for those listed in this ETF.

Technology companies are already listed on NASDAQ. QQQ stocks provides an additional opportunity for traders to invest in limited space, despite holding individual stocks of technology companies. This property makes Q Stock a relevant option for trading in the technology space.

Fintechzoom QQQ Stock an Investment Option

Choosing Fintechzoom QQQ stock as an investment option for the investor would be profitable as it is directly or indirectly linked with technological growth.

Technology companies are growing daily with fast-forwarding AI integration and genius module induction.

Technology is growing with supersonic speeds and will experience hypersonic in the coming days. So, investors, in return, may get high amounts of dividends and handsome investment returns.

Green energy evolution is another addition to the modern economy. Moreover, it mirrors the NASDAQ-100 index, a basket of top technology companies. Financial experts are constantly monitoring the index.

Composition of Q index

The ETF comprises various industry players, especially technology giants such as Amazon, Alphabet, Google, Apple Inc., and Microsoft. It also encompasses non-tech sectors such as Consumer Services like Starbucks and Costco, Health Care such as Amgen and Gilead Sciences, and Consumer Goods like PepsiCo. These sectors help diversify the ETF’s portfolio beyond technology, providing exposure to a broader range of industries within the Nasdaq-100.

- Technology companies hold significant weight

- Non-tech companies for diversification

- Healthcare and consumers are added for sustained balance.

Historical Data and Performance

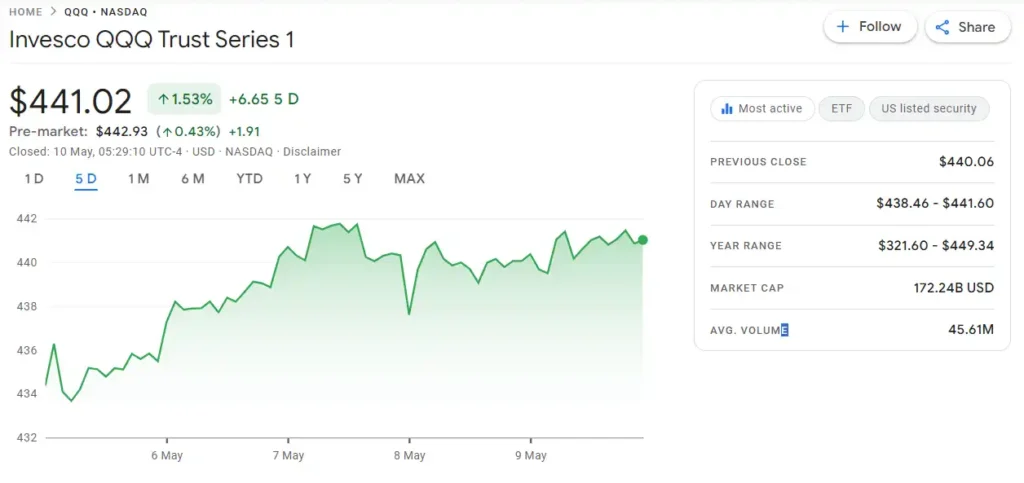

Wise investors always focus on deep analysis and think about the long-term benefits. The past stock analysis, whether QQQ or any crypto Fintechzoom, gives a graphical track record. This makes an investor more informed and aids in correct decision-making. Looking at the historical data of QQQ stocks, you’ll find sustainable growth in the long run. QQQ stocks experienced high growth volume in the past five years, giving future investors confidence. According to Yahoo Finance, the QQQ trust net assets are 259.27B, with a 35 percent positive growth return in 2023 alone and a positive 8 percent in 2024, a positive signal for investors.

Current Market Trends

The stock market never remains the same. It is volatile, with minute happenings within the United States and globally. Market Trends change daily, and market dips and pips are unpredictable for child investors. So, investors of QQQ stocks keep their eyes on QQQ stock’s performance analysis.

Trading is a game of seconds, and QQQ stock is at that moment when we are talking, trading at its peak. New investors should seek proper financial guidance before making a bold decision.

If you plan for the long term, it would be investable due to technological growth volatility. I think short-term spot traders can grab limited but sustainable profits, but it may need to be corrected in your case.