VAT Calculator

Governments generate their revenues from a variety of mediums. Those mediums can be state-owned enterprises SOEs and imposing different types of taxes. Consumers and businesses encounter various types of taxes, one the most common being the Value-added Tax VAT. Whether you are in a manufacturing business, need to calculate the VAT, or buying something, a VAT calculator could be a suitable tool to simplify complex calculations.

This read will enable you to understand the importance of the VAT calculator, how to use it effectively to make informed decisions in business or while making purchases, and provide answers to common questions about the VAT calculator.

Introduction

A VAT calculator is a simple tool used to calculate the Value-added tax applied to goods and services. Businesses collect Valued-added tax from the consumers and deposit a certain amount to the government. VAT is a type of indirect tax that you will pay when you buy physical goods or services.

Businesses import raw materials and pay tax on these imports. Add value to those raw materials by making actual usable products for the consumers. When selling finished products, they add VAT to the net price of the product. Consumers pay the Gross Price of the finished products including VAT. In the end, businesses deduct the amount of VAT they paid to the govt initially and remit the difference VAT to the govt. The VAT calculator tool is useful for both businesses and consumers to calculate the amount they would pay to the govt in shape of VAT.

VAT rates differ from country to country depending upon the policies. According to Gov.uk, 20% is the standard VAT rate, whereas it is 5% for various products for children, and 0% for food items. Check your official government online information portals to know the actual amount of VAT rates.

See More Calculators: Percentage Calculator | BCV calculator | Playback speed Calculator

How it Works

The calculator for VAT amount works on a simple mathematical formula. You can calculate the Gross price by either adding the VAT rate or subtracting it from the net price.

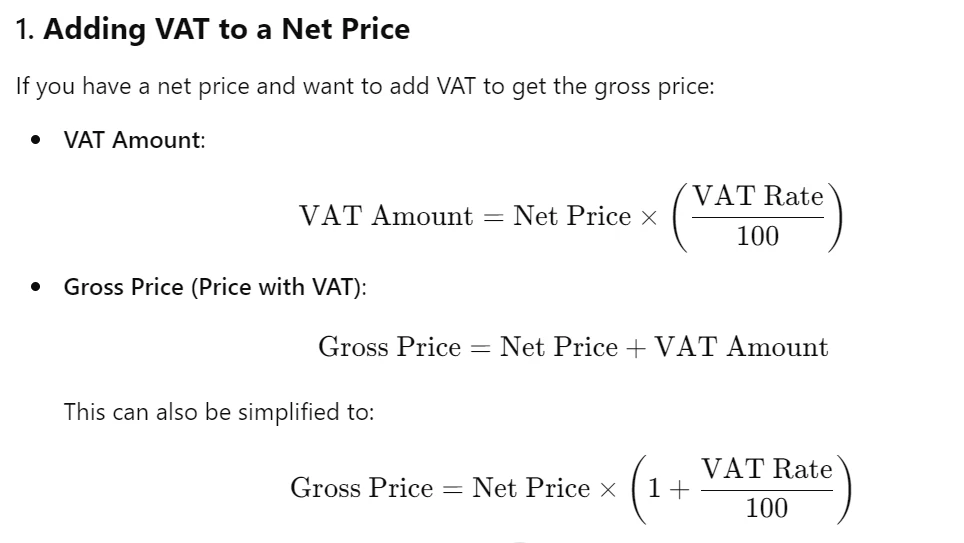

Adding a percentage of VAT

VAT amount = Net price x (VAT rate / 100)

For the Gross price (Price including VAT):

Gross Price = Net price + VAT amount

OR

Gross Price = Net price x (1+VAT rate / 100)

See the image below:

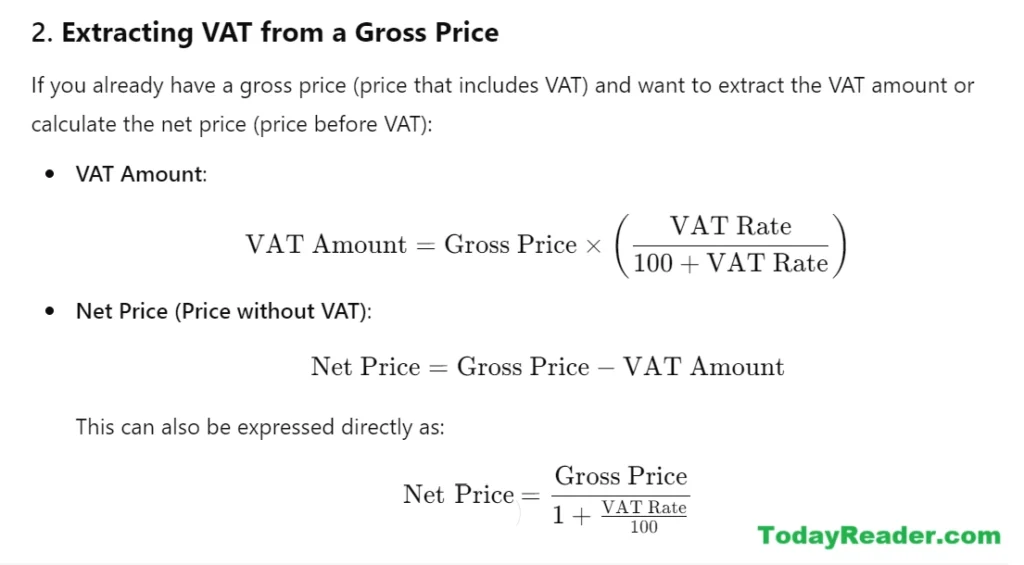

Subtracting VAT rate

Suppose you already know the product's gross price. See below to subtract the VAT from the gross price or know the net price of that product:

VAT amount = Gross Price x ( VAT rate /100 + VAT rate )

Get the net Price:

Net Price = Gross - VAT amount

The net price formula is expressed directly as follows:

Net price = Gross Price / (1 + VAT rate / 100)

See the image for reference:

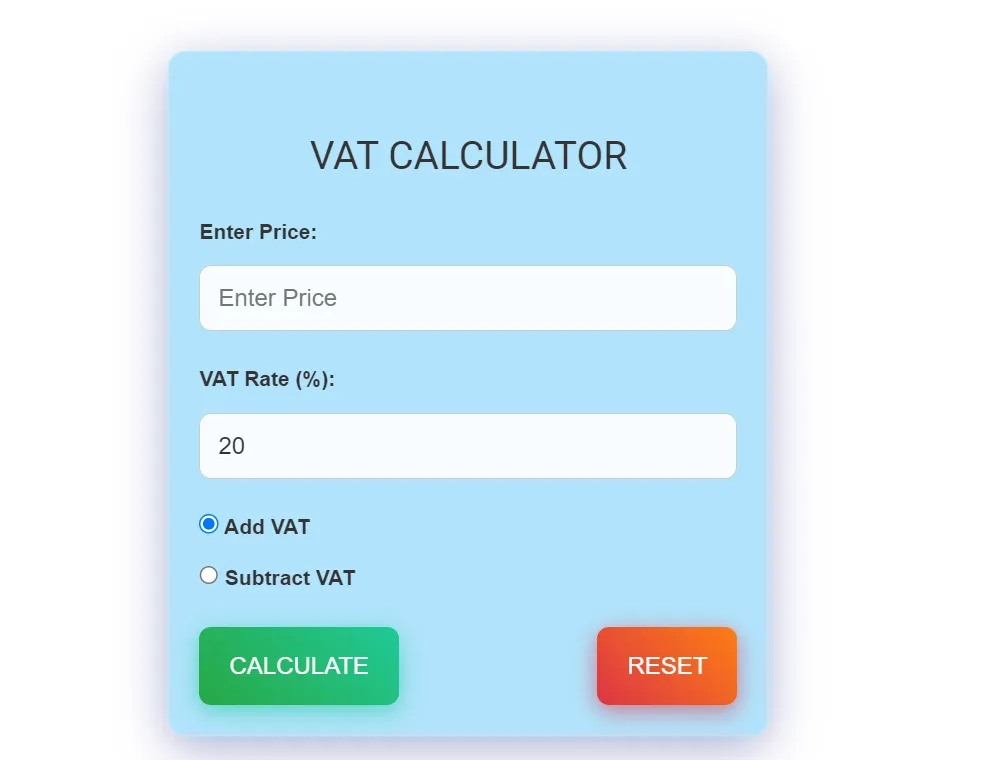

How to use VAT calculator

By putting simple input e.g. net or gross price and VAT percentage being charged, you can calculate the VAT amount added or extract it from the gross price with just one click.

For example, if the net price of the product is $150 and the VAT rate is 20%

The gross price and VAT amount should be $180 and $30 respectively.

Adding VAT rate

VAT amount (Va):

Va = Net price * (VAT rate / 100)

VAT amount = 150 x ( 20 / 100)

VAT amount = 30

Gross Price (Gp):

Gross Price = Net price + VAT amount

Gp = 150 + 30

Gross price = 180

Subtracting VAT rate

Suppose gross price of the product is $180

To subtract the VAT from gross price for net price:

VAT amount (Va):

Va = Gross price * (VAT rate / 100 + VAT rate)

VAT amount = 180 * ( 20 / 100 + 20)

VAT amount = 30

Net Price (Np):

Net price = Gross Price - VAT amount

Np = 180 - 30

Net Price = 150

Wrap-up

The Value-added tax calculator is an essential tool to make informed decisions in the tax driven economy. You should calculate the amounts prior buying something to know what would be the VAT being charged by the govt authorities. Manufacturers calculate the VAT at initial stage to set the gross price. They charge the consumers and deduct the VAT they paid on raw material imports and remit the leftover to the government authorities.